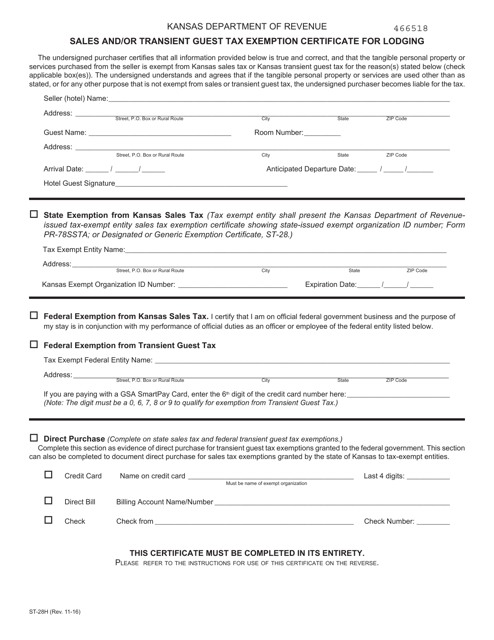

kansas sales and use tax exemption form

Wholesalers and buyers from other states not registered in Kansas should use. Of any exemption certificate or publication from.

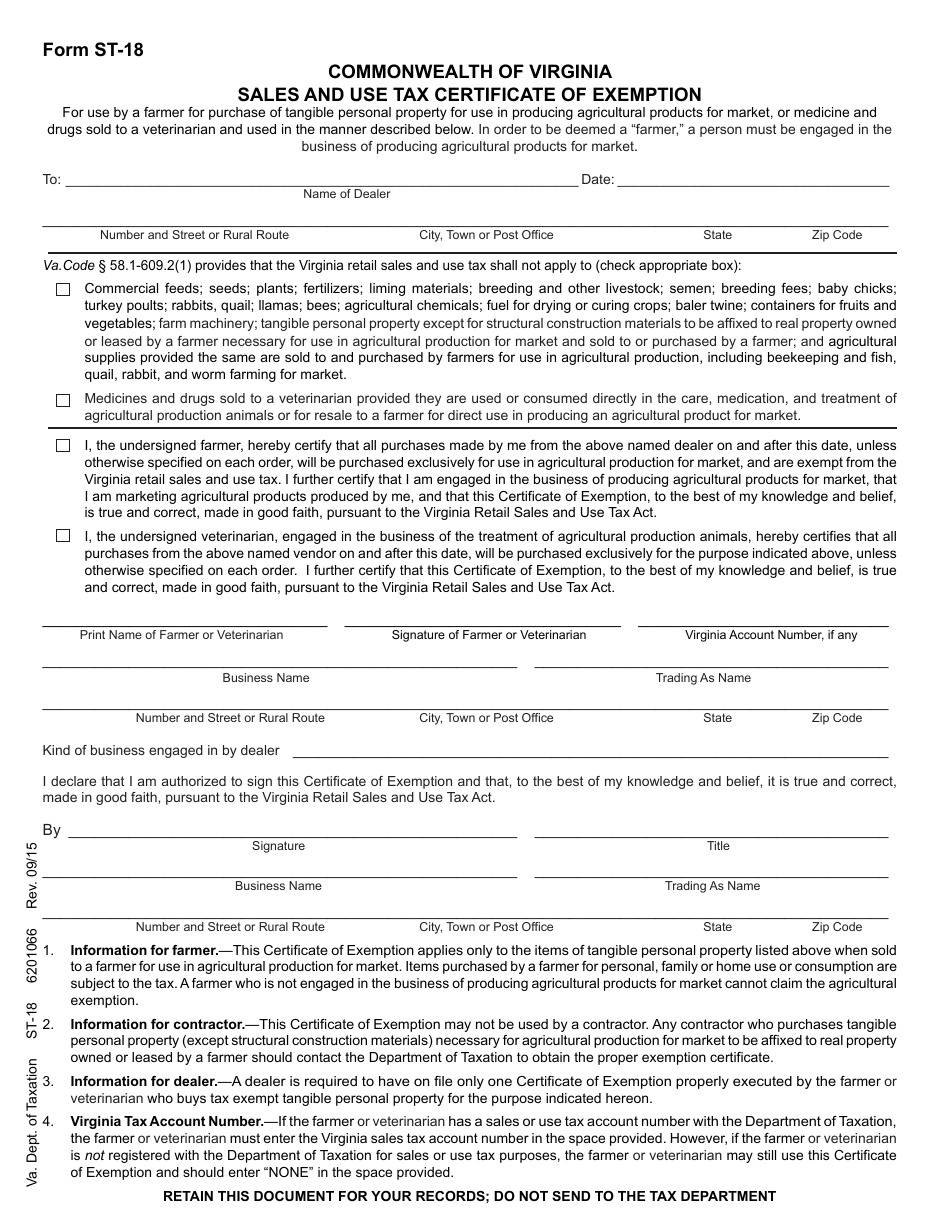

Form St 18 Download Fillable Pdf Or Fill Online Sales And Use Tax Certificate Of Exemption Virginia Templateroller

11-15 properly use Kansas sales and use tax exemption certificates as buyers.

. Nonprofit groups or organizations exempt by law from collecting tax on their retail sales of tangible personal property such as a PTA or a nonprofit youth development organization should use the exemption certificate issued to it by the Kansas Department of Revenue when buying items for resale. Enter the name of your business and its complete. If you are applying for a property tax exemption pursuant to the following statutes you must attach a completed Addition to your TX application form.

You may also obtain the. Agricultural ST-28F Aircraft ST-28L. Sales Tax Account Number Format.

Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. And all sales of repair. Once the KsWebTax is created you will be taken to the Exemption Certificate page.

Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 3. Your Kansas Tax Registration Number. The contents should not be used as authority to support a technical position.

Give your assigned exemption number where indicated. TX Application Form pdf Additions to Property Tax Exemption Application. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from.

For other Kansas sales tax exemption certificates go here. 79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible personal property in a warehouse or distribution facility in Kansas all sales of installation repair and maintenance services performed on such machinery and equipment. Tax Policy and Statistical Reports.

From that date Kansas exempt entities claiming a sales or use tax exemption must provide this completed exemption certificate which includes their tax exempt number to the retailer. Misuse SAMPLE EXEMPT ENTITY CERTIFICATE. Keep these notices with this booklet for future reference.

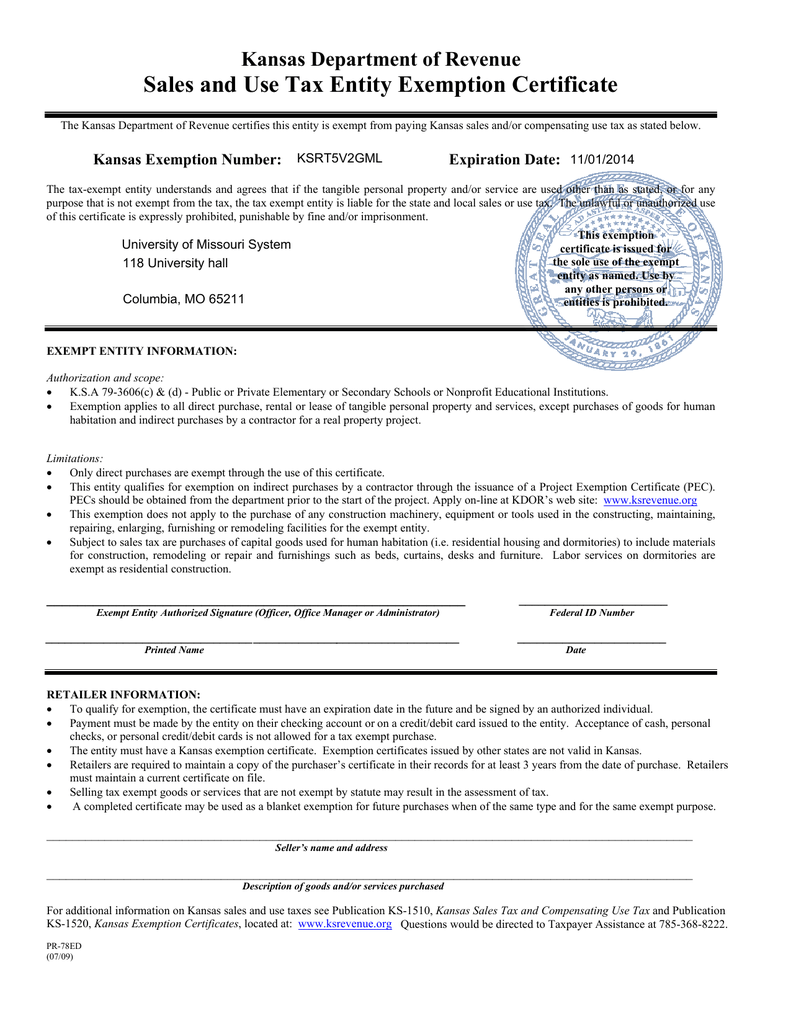

Select the application Add an Existing Tax Exempt Entity Certificate to this account. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. 10012024 The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not.

It is designed for informational purposes only. Streamlined Sales Tax Certificate of Exemption Do not send this form. Street RR or P.

You can download a PDF of the Kansas Contractor Retailer Exemption Form ST-28W on this page. 79-201 Ninth Humanitarian service provider TX Addition 79-201 Ninth pdf KSA. How to use sales tax exemption certificates in Kansas.

Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. This form is to be completed and submitted to the Division of Financial Services by the 5th. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

Street RR or P. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 2.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Is exempt from Kansas sales and compensating use tax for the following reason. 79-201b Hospitals Group.

The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. For other Kansas sales tax exemption certificates go here.

The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not. Revenues basic sales tax publication KS-1510 Kansas Sales and Compensating Use Tax. The application will ask for your Kansas Tax Exemption Number and a PIN.

Residency issues arise when a nonresident and a Kansas resident are both listed on the purchase agreement andor vehicle title. _____ Business Name. This is a multi-state form for use in the states.

In this instance. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not. Your Kansas sales tax account number has three distinct parts.

The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt from sales and use tax. Each tax type administered by the Kansas. The Kansas Department of Revenue has revised form ST-8B to clarify the requirements for the sales tax exemption for sales of vehicles to nonresidents.

Order for the sale to be exempt. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. The following entities and organizations are exempt and issued a Tax Exempt Entity Certificate from the Kansas Department of Revenue.

For a Kansas sales tax exemption certificate to be provided to vendors for University purchases or for information regarding the Universitys sales tax exemption status in other states please contact KSU General Accounting office at 785 532-6202. Box City State Zip 4 _____ is exempt from Kansas sales and compensating use tax for the following reason. You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Form SST on this page.

Box City State Zip 4. Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and Compensating Use Tax exemption certificates. The 004 is the number assigned to Retailers Sales Tax.

The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not exempt from the tax the tax exempt. Department of Revenue has been assigned a number. Click Continue and review to ensure you have the correct certificate then click Save.

Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 1. As a registered retailer or consumer you will receive updates from the Kansas Department of Revenue when changes are made in the laws governing sales and use tax exemptions. Sales tax exemptions are also.

Enter the expiration date of your exemption status. Kansas Sales Tax Exemption Certificate information registration support. Ad New State Sales Tax Registration.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. To apply for update and print a sales and use tax exemption certificate.

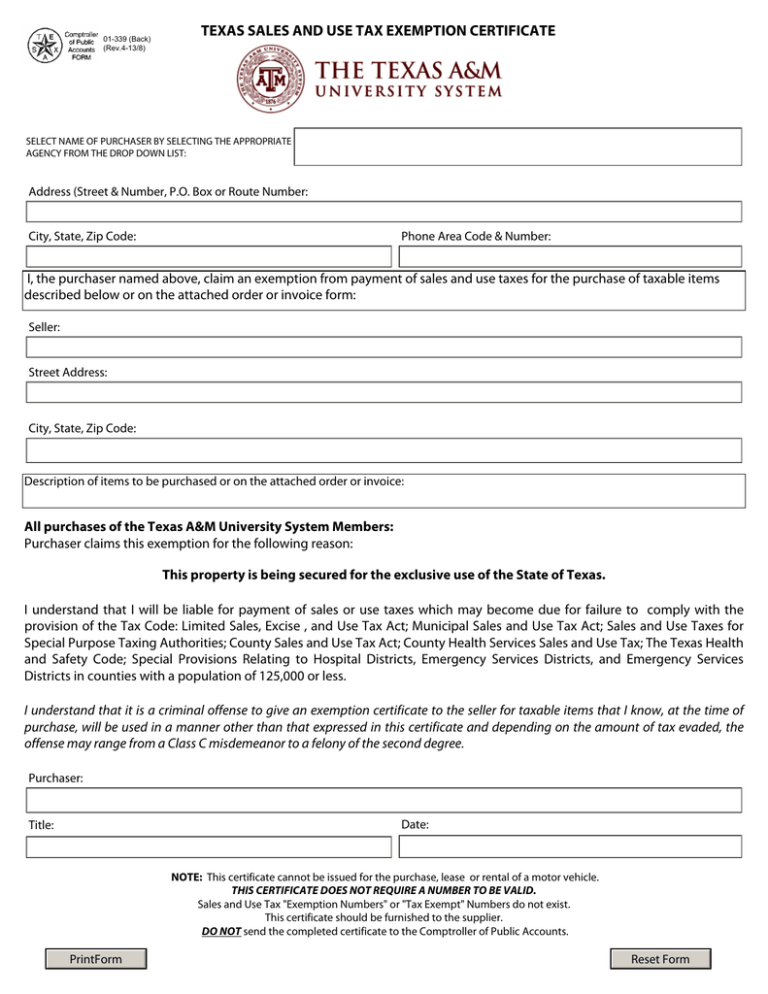

Texas Sales And Use Tax Exemption Certificate

Texas Sales And Use Tax Exemption Certification Blank Form Ideal Throughout Resale Certificate Request Letter Certificate Templates Letter Templates Lettering

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Printable Missouri Sales Tax Exemption Certificates

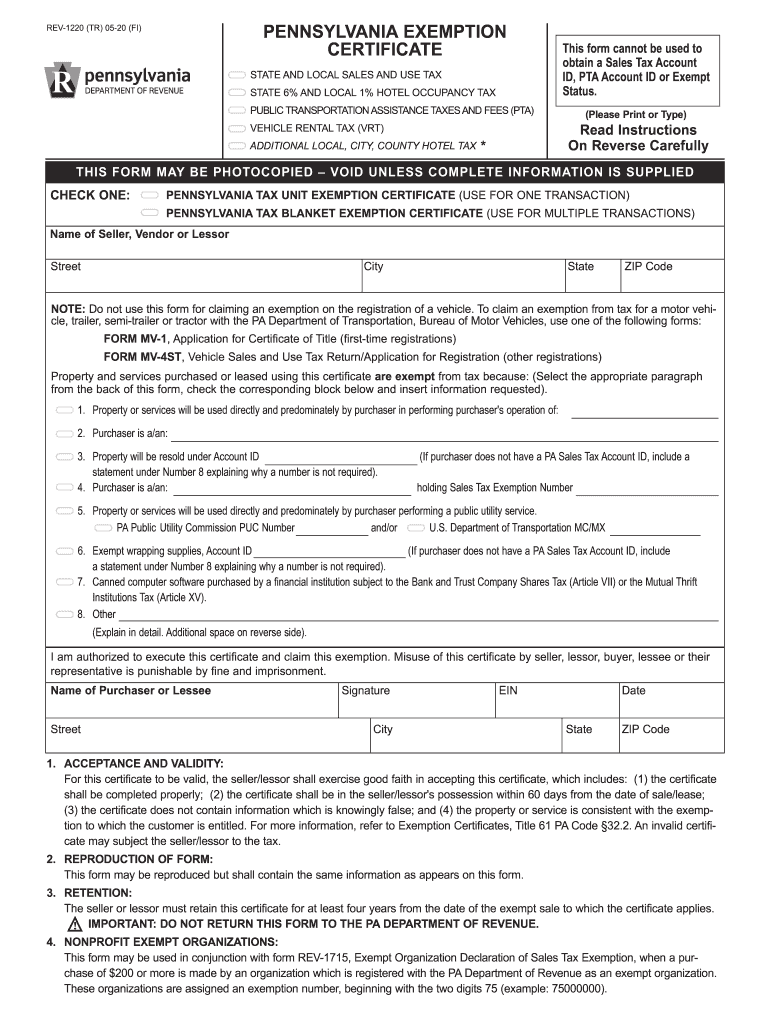

Pennsylvania Exemption Certificate Fill Out And Sign Printable Pdf Template Signnow

Sale Vintage Wwii Gas Tax Exemption Booklet Kansas Home Front Etsy Gas Tax Booklet Wwii

E 595e Web Fill 12 09 Fill Online Printable Fillable Blank Pdffiller

Application For Hospital Sales Tax Exemption Tax Exemption Illinois Sales Tax

What Is A Sales Tax Exemption Certificate And How Do I Get One

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue